Bir Tax Calendar 2026 May Unbelievable. Please note that this is just a basic listing and should not be taken as complete or accurate. The due date for belated and revised.

You can view the specific filing dates and deadlines. The due date for belated and revised. A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026.

Source: www.slideshare.net

Source: www.slideshare.net

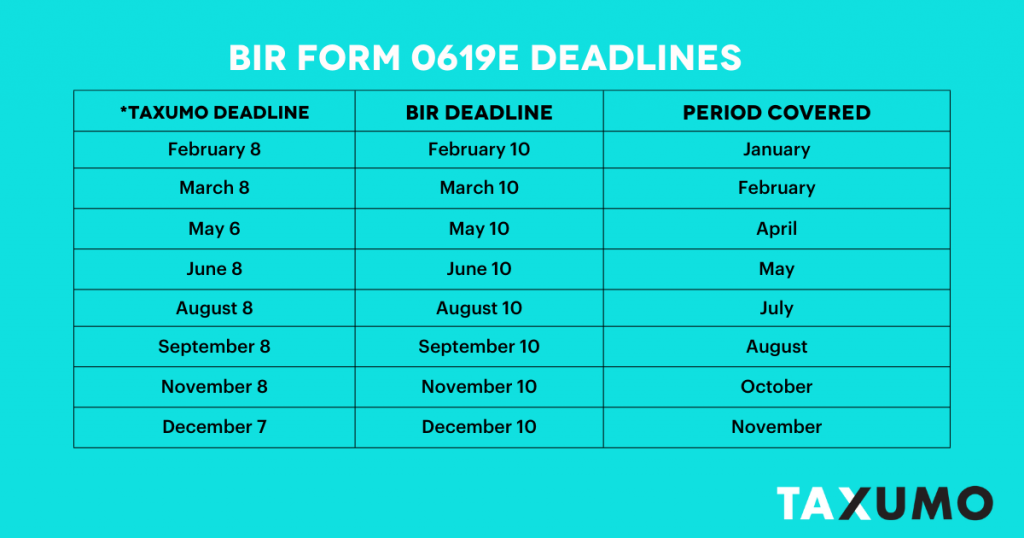

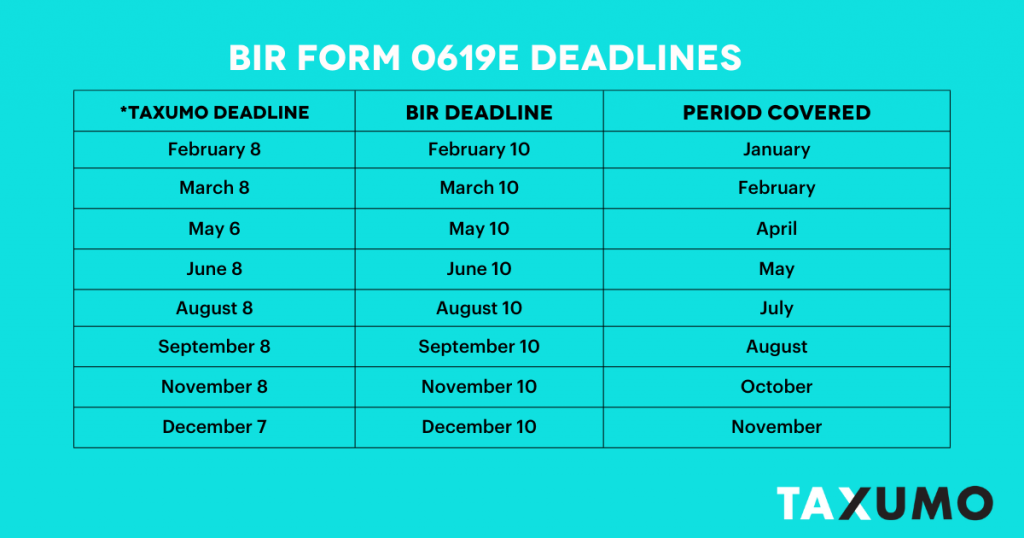

2024birtaxcalendar.pdf To ensure timely filing, juantax follows a separate schedule tailored to its platform. A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026.

Source: www.taxumo.com

Source: www.taxumo.com

BIR Form 0619E and Your Tax Computation in the Philippines The due date for belated and revised. Stay updated with the bir tax calendar 2025.

Source: bettyeyemmalynne.pages.dev

Source: bettyeyemmalynne.pages.dev

Bir Tax Calendar May 2025 Leigh Meagan You can view the specific filing dates and deadlines. Avoid penalties with timely filings.

Source: aidenamerewether.pages.dev

Source: aidenamerewether.pages.dev

Bir Tax Calendar 2025 May Aiden A. Merewether Please note that this is just a basic listing and should not be taken as complete or accurate. You can view the specific filing dates and deadlines.

Source: www.pinterest.ph

Source: www.pinterest.ph

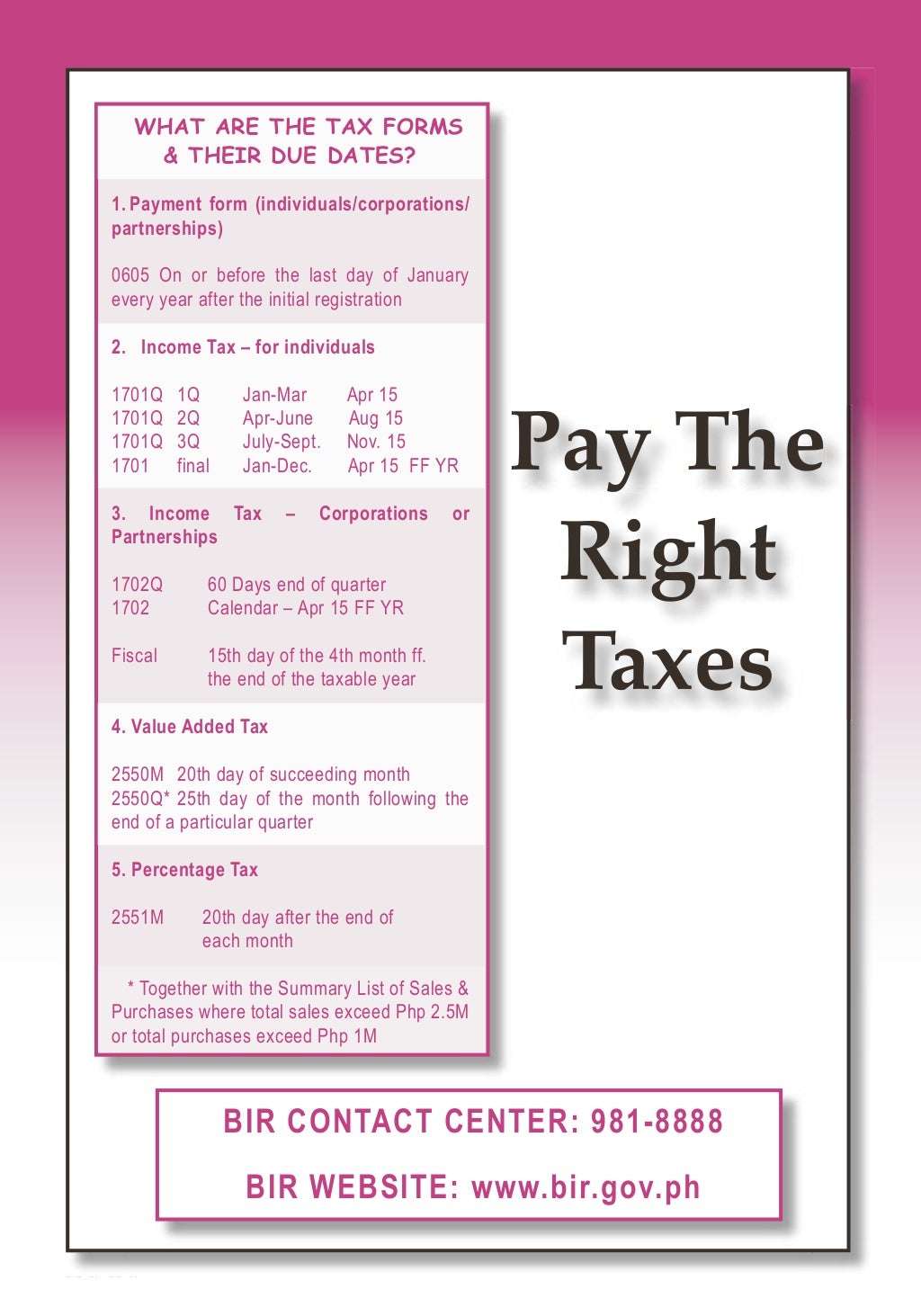

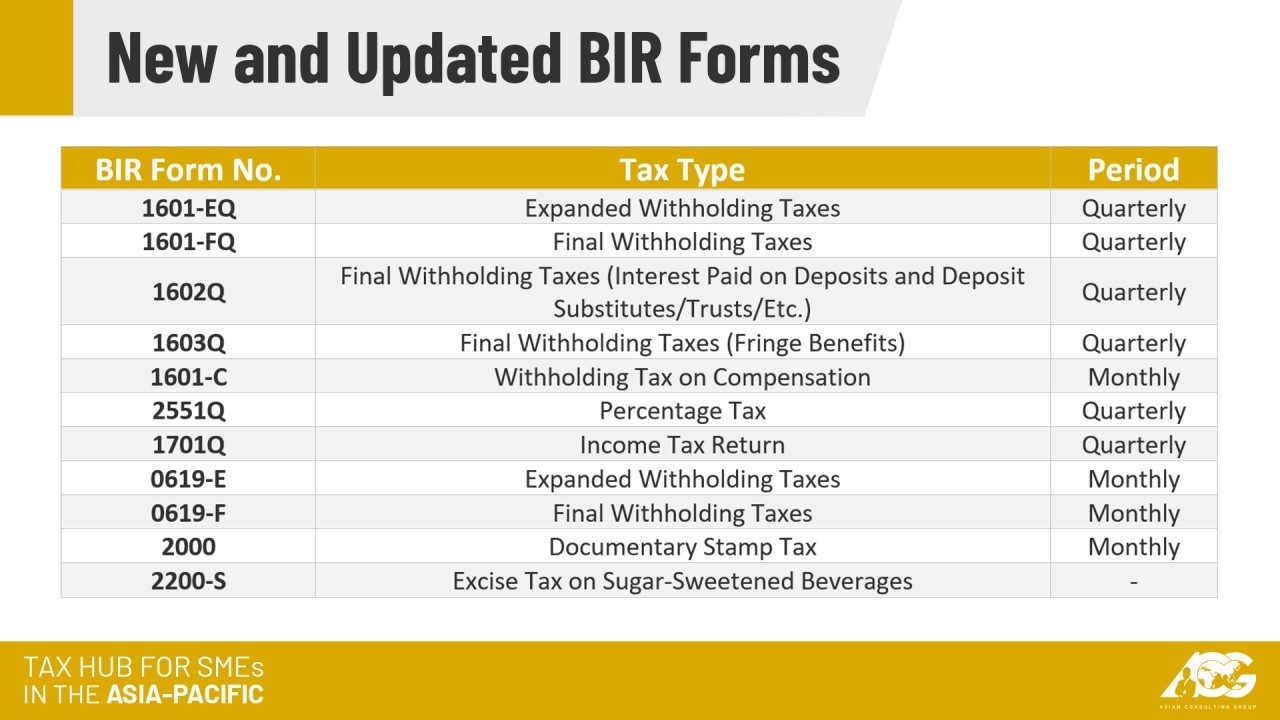

BIR Tax Deadlines Tax deadline, Tax, Business entrepreneurship You can view the specific filing dates and deadlines. Stay updated with the bir tax calendar 2025.

Source: bobbysriley.pages.dev

Source: bobbysriley.pages.dev

Bir Tax Calendar 2025 Downloadable Bobby S. Riley A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. Please note that this is just a basic listing and should not be taken as complete or accurate.

Source: www.bworldonline.com

Source: www.bworldonline.com

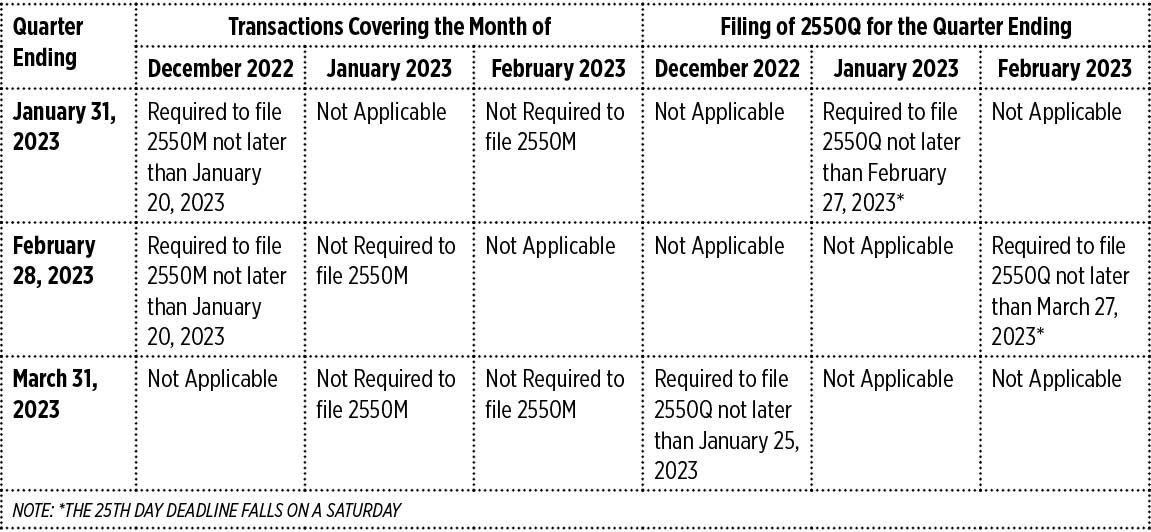

A closer look at quarterly VAT filing BusinessWorld Online A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. You can view the specific filing dates and deadlines.

Source: meganimerrill.pages.dev

Source: meganimerrill.pages.dev

Bir Tax Calendar May 2025 Megan I. Merrill The due date for belated and revised. Stay updated with the bir tax calendar 2025.

Source: jenniejturner.pages.dev

Source: jenniejturner.pages.dev

Bir Tax Calendar May 2025 Jennie J. Turner A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. The bureau of internal revenue (bir) website (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the philippine tax laws and their implementing regulations and revenue issuances, including information on bir programs and projects.

Source: aprilmharris.pages.dev

Source: aprilmharris.pages.dev

Bir Tax Calendar 2025 Downloadable April M. Harris To ensure timely filing, juantax follows a separate schedule tailored to its platform. Avoid penalties with timely filings.

Source: cindraycaitrin.pages.dev

Source: cindraycaitrin.pages.dev

Bir Tax Table 2024 Eloise Jemimah The due date for belated and revised. You can view the specific filing dates and deadlines.

Hi mga KaNova!! 2025 BIR Tax Calendar is now available. You may scan A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. To ensure timely filing, juantax follows a separate schedule tailored to its platform.